This Ponzi vs Pyramid schemes post aims to show you the difference between Ponzi Schemes and Pyramid Schemes, which are not the same things. Many people believe they are. Some are unable to tell the difference and therefore use the terms interchangeably. Many Ponzi schemes have elements of pyramid schemes but ultimately these are two different forms of what ultimately boils down to fraud.

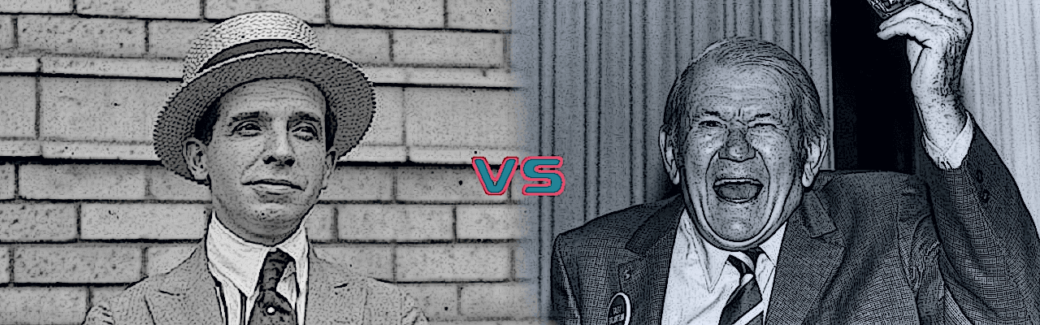

Ponzi vs Pyramid

The definition of a Ponzi scheme according to the free dictionary:

A fraud disguised as an investment opportunity, in which initial investors and the perpetrators of the fraud are paid out of funds raised from later investors, and the later investors lose all funds invested.

According to the Merriam-Webster dictionary, in contrast, a pyramid scheme (effectively what all multilevel marketing companies are) is defined as:

A usually illegal operation in which participants pay to join and profit mainly from payments made by subsequent participants.

The Ponzi Scheme

We name Ponzi schemes after Charles Ponzi. He duped investors in the 1920s with a postage stamp speculation scheme.

A Ponzi scheme is an investment fraud that pays existing investors with money that the operators collect from new investors. Ponzi scheme organizers usually promise to invest your funds. They also promise to generate a high yield with little or no risk. The fraudsters hardly ever invest the money. Instead, they pay those who invested earlier. Furthermore, they almost always keep some for themselves.

Ponzi schemes require a constant flow of new money to keep going. When large numbers of investors cash out or when recruitment becomes difficult, the scheme collapses. This is a major difference between Ponzi vs Pyramid schemes and part of the reason many Ponzi schemes have a pyramid/MLM element.

The Pyramid Scheme

Carl F. Rehnborg is the father of the pyramid scheme as we know it. He started with an MLM business, Nutrilite, selling vitamins and “health” products using the multilevel marketing model.

There are 4 main pillars to a successful pyramid scheme. You should understand these pillars when comparing Ponzi vs Pyramid schemes.

- An endless chain allowing recruiters to keep on recruiting more and more downlines… until we run out of earthly inhabitants.

- Participants have to pay to play. To take part you need to pay and to continue participation you need to keep paying or reach specific thresholds. These thresholds may also be a set of goals or targets.

- There will be some sort of recruiting mandate. This may at first be massaged as optional but the more you get dragged in, the more forceful the need to recruit will be.

- Money moving up the line. Participants always transfer value toward the top of the pyramid. Sometimes it appears to be a fair or equitable exchange. You will notice that participants almost always exchange good money for bad money. Examples are vouchers, tokens or positions which can be exchanged at a later date.

Sounds an awful lot like a multilevel marketing scheme now doesn’t it? That is because it is exactly what it is. You should not be fooled by proprietary language when you Ponzi vs Pyramid schemes!

Multilevel Marketing or Direct Marketing / Direct Sales

Don’t fall for this narrative. Why would any product in today’s day and age require a direct sales mechanism? Only insurance salesman would argue otherwise. They might have this opinion because the advance of the internet put them out of business.

Multilevel marketing schemes are legal pyramid schemes. They get away with it because they manage to convince regulators and authorities that they have legitimate products. On top of that, they spend a lot of money on lawyers and lobbyists to silence their critics.

You have to ask yourself: If these products or services were so good, why have bigger conglomerates not bought these companies or products?

Why are they not available from expected sources?

For example, promotors will have you believe the G999 token is supposedly going to change the world and is apparently a technological marvel. Why do major exchanges like Binance, Bitstamp, Coinbase or Kraken not list it?

Ponzi vs Pyramid Scheme Attributes Side by Side

| Ponzi Scheme | Pyramid Scheme |

|---|---|

| High returns with little or no risk | Emphasis on recruiting |

| Overly consistent returns | No genuine product or service is sold |

| Unregistered investments | Promises of high returns in a short time period |

| Unlicensed sellers | Easy money or passive income |

| Secretive, complex strategies | No demonstrated revenue from retail sales |

| Issues with paperwork | Complex commission structure |

| Difficulty receiving payments | No experience needed |

Summary

Ins summary, when you compare a Ponzi vs Pyramid scheme, the main difference is simple. A Ponzi scheme promises profits at a later date from a magic black box. In contrast, a pyramid scheme promises profits from recruiting other participants to the scheme.